23

Share this post

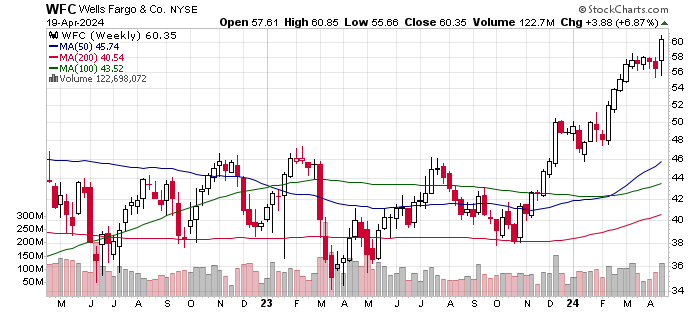

Wells Fargo Update | $WFC

www.brinkeradvisor.com

18

Share this post

Treasury Auctions, CD Rates, and LEI

www.brinkeradvisor.com

21

Share this post

Series I Bonds & CPI Inflation Update

www.brinkeradvisor.com

84

Share this post

Model Portfolios | April Update

www.brinkeradvisor.com

30

Share this post

FOMC Meeting and Leading Economic Indicators

www.brinkeradvisor.com

24

Share this post

Treasury Auctions, Cash and CD Rates

www.brinkeradvisor.com

83

Share this post

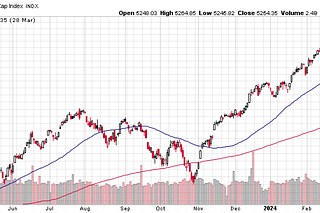

Model Portfolios | March Update

www.brinkeradvisor.com

35

Share this post

Leading Economic Indicators

www.brinkeradvisor.com

Brinker Advisor

Our favorite investment ideas along with our views on the economy, monetary policy, and related topics. Subscribers have access to our Brinker Fixed Income Advisor and Marketimer Model Portfolios as well as our List of Recommended No-Load Funds.

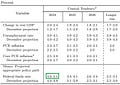

Model Portfolios

Share this publication

Brinker Advisor

www.brinkeradvisor.com

© 2024 Bob Brinker

Substack is the home for great culture